tempe az sales tax rate 2020

County and city taxes. The 81 sales tax rate in Tempe consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 18 Tempe tax.

2021 Arizona Car Sales Tax Calculator Valley Chevy

On January 1 2020 the following Mohave County Navajo County the City of Phoenix and the Town of Kearny will all experience TPT rate.

. 303 rows 2022 List of Arizona Local Sales Tax Rates. Sales Tax Calculator. Lowest sales tax 56 Highest sales tax 111 Arizona Sales Tax.

Tempe Sales Tax Rates for 2022. This rate includes any state county city and local sales taxes. Apply or Renew on the Accela Citizen AccessACA Portal.

Click The Logo Below To View The Model City Tax Code. The Tempe Arizona sales tax is 810 consisting of 560 Arizona state sales tax and 250 Tempe local sales taxesThe local sales tax consists of a 070 county sales tax and a 180. Tempe has a lower sales tax than 692 of arizonas other cities and counties.

2020 Arizona Sales Tax Rates. What is the sales tax rate in Tempe Arizona. Average sales tax with local.

28 lower than the maximum sales tax in AZ. However you may need either a Transaction Privilege Tax License aka TPT or sales tax license and a Tempe Regulatory License. 2020 rates included for use while preparing your income tax deduction.

The latest sales tax rates for cities in Arizona AZ state. Apply File Pay Transaction Privilege Tax TPT or sales tax at AZTaxesgov. 23 lower than the maximum sales tax in AZ.

Prior Combined Tax Rates Phoenix. 2020 rates included for use while preparing your income tax deduction. If this rate has been updated locally please contact us and we will update the sales tax rate for Tempe Arizona.

The december 2020 total local sales tax rate was also 6300. 83 Sales Tax Chart Combined State of Arizona Maricopa County City of Phoenix tax due on Retail Sales from 001 to 100. Tempe Az Sales Tax Rate 2020.

Average Sales Tax With Local. Subject to Transaction Privilege TaxTPT or sales tax an alternative to hotels and motels but taxed the same. 28 lower than the maximum sales tax in AZ.

Use the physical address or the zip code. Tempe in Arizona has a tax rate of 81 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tempe totaling 25. The latest sales tax rate for Tempe Junction AZ.

This is the total of state county and city sales tax rates. Arizona sales tax changes effective January 2020. Failing to do so will.

Tempe Privilege Tax from. The 86 sales tax rate in Phoenix consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 23 Phoenix tax. Tempe Tax Code And Regulations.

Tempe 250 560 Tolleson 320 560 Wickenburg 290 560 Youngtown 370 560 Pinal County Local General Sales Tax AZ State Sales Tax. Arizona Tax Rate Look Up Resource. This resource can be used to find the transaction privilege tax rates for any location within the State of Arizona.

See reviews photos directions phone numbers and more for sales tax. The minimum combined 2022 sales tax rate for Tempe Arizona is. Not Taxed By State.

2021 Arizona Car Sales Tax Calculator Valley Chevy

Food Delivery Businesses And Sales Tax Issues Henry Horne

Required Sales For Target Profit Wize University Managerial Accounting Textbook Wize

Arizona Mortgage Calculator Smartasset

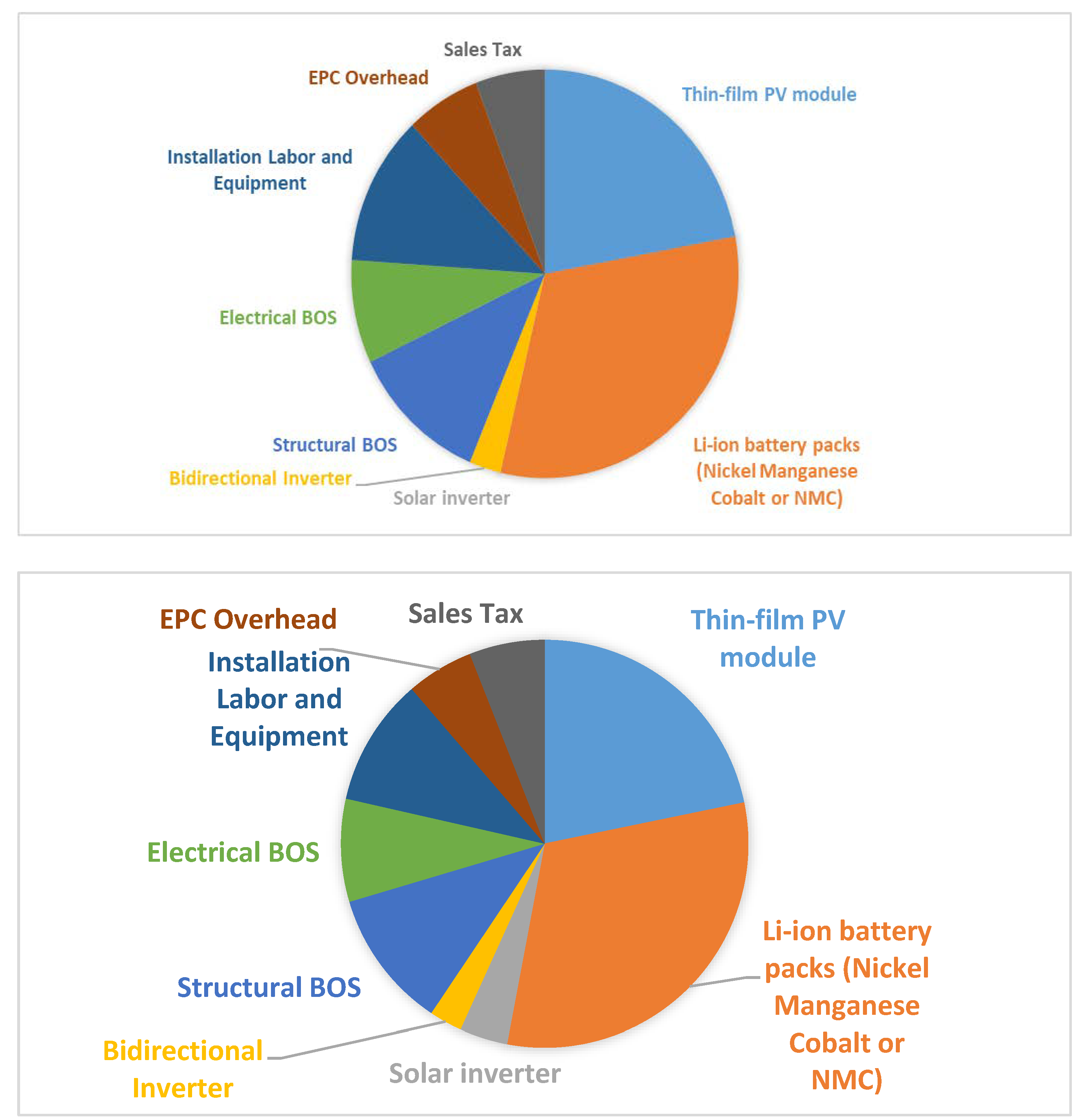

Energies Free Full Text Assessing The Techno Economics And Environmental Attributes Of Utility Scale Pv With Battery Energy Storage Systems Pvs Compared To Conventional Gas Peakers For Providing Firm Capacity In California

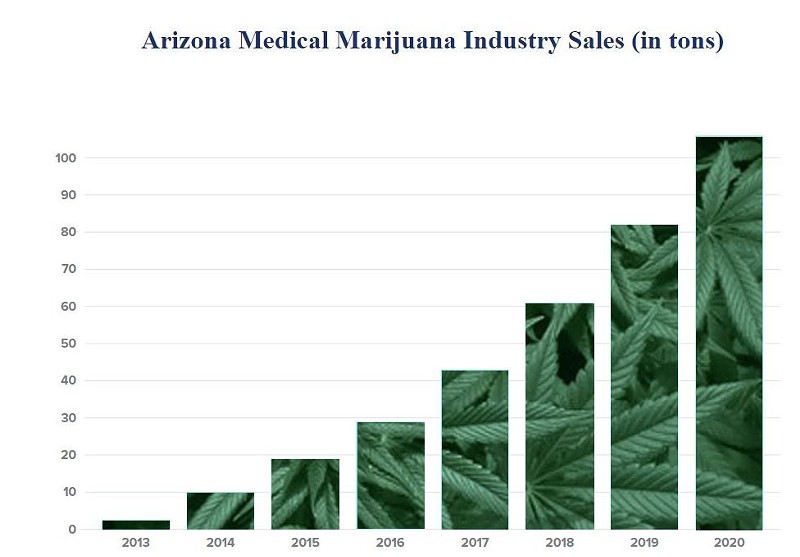

Arizona Cannabis Sales Expected To More Than Double In 2021 Phoenix New Times

Highest Gas Tax In The U S By State 2022 Statista

Is Food Taxable In Arizona Taxjar

Real Estate Is King How Michael Crow Found A Way To Fund And Expand Arizona State University The Arizona State Press

Austin 2018 Property Tax Rate Map By Zip Code Emily Ross

Ahwatukee Az Real Estate Housing Report For March 2021 Arizona Real Estate Real Estate Home Buying

Is Food Taxable In Arizona Taxjar